Award-winning PDF software

W9 Ument: What You Should Know

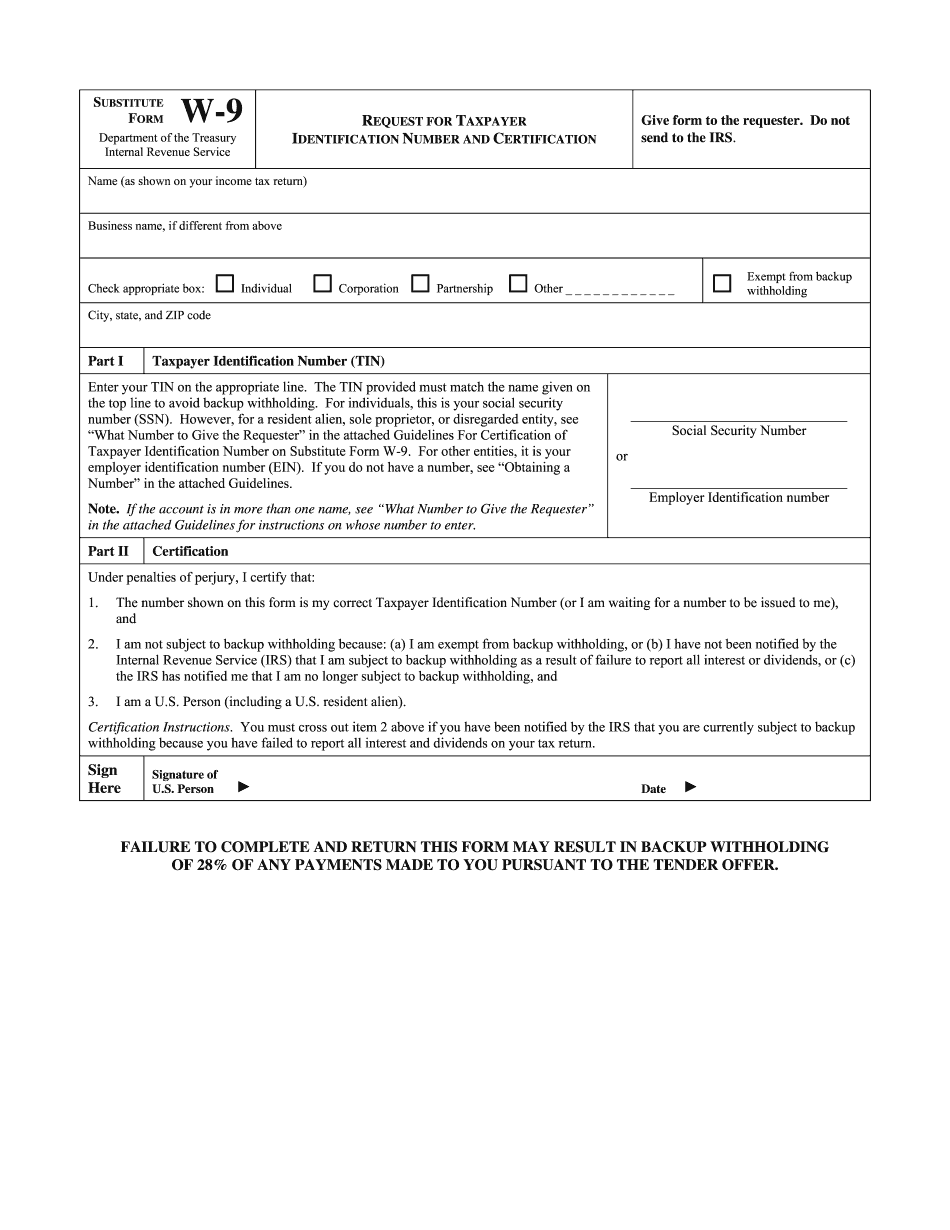

IRS forms have a number of different names, but there are three main names for IRS W-9 forms — the Electronic Federal Tax Return, the Electronic Federal Tax Settlement and the What IRS W-8BEN form is, how do I fill it out and what does it mean? IRS Form 842 or 844 is a federal Form you can use to request to be paid or receive payment. You may receive two types of payment forms from the IRS at the same time. This is known as “two-step processing” and it requires that you first submit Form 842 (Payment for a Form 841 or 843) to the IRS and then wait for the money to take effect, and submit a follow-up 844 (Received Payment for a Form 845 for an Amount That Should Have Been Paid By the Federal Tax Year) to get a money order (as payment) from the IRS. Why are some forms called 982 and 983, and why does IRS want my social security number and driver's license number? You can get a copy of the above forms through the government website. The forms are usually called 982, 983 and 984, but not 982-T and 982-Q, respectively. Why are some forms called and why does IRS want my social security number and driver's license number? What is an Electronic Federal Tax Return Form? IRS Forms are generally called Electronic Federal Tax Returns, which are the forms that taxpayers use to submit their taxes to the IRS. While the forms might be called “982” or “983” for various reasons, you will generally receive a 982, 983 or 984 if you file a separate tax return using your tax information provided on the form. The 982, 983 or 984 can be the same form if you submit your tax information on multiple forms. If I file a separate return using my taxes provided on the other Form 982 or 983, will IRS accept the return, and if so, will the IRS notify me of the filing? IRS is a secure agency and will only accept a separate tax return if the individual has filed a Federal tax return for the current tax year.

Online methods make it easier to to prepare your doc management and supercharge the productiveness of your workflow. Comply with the quick tutorial in an effort to entire W9 Ument, avoid mistakes and furnish it in the well timed way:

How to finish a W9 Ument on the web:

- On the web site along with the form, click Begin Now and move to the editor.

- Use the clues to complete the appropriate fields.

- Include your personal data and call data.

- Make guaranteed that you just enter appropriate information and numbers in ideal fields.

- Carefully look at the written content within the type at the same time as grammar and spelling.

- Refer that can help part if you've got any concerns or handle our Aid crew.

- Put an digital signature on the W9 Ument with the guidance of Signal Software.

- Once the shape is finished, press Carried out.

- Distribute the completely ready sort via email or fax, print it out or conserve on the device.

PDF editor makes it possible for you to definitely make variations with your W9 Ument from any on-line linked gadget, customise it in accordance with your preferences, indication it electronically and distribute in various approaches.