Award-winning PDF software

Boston Massachusetts W9 Ument: What You Should Know

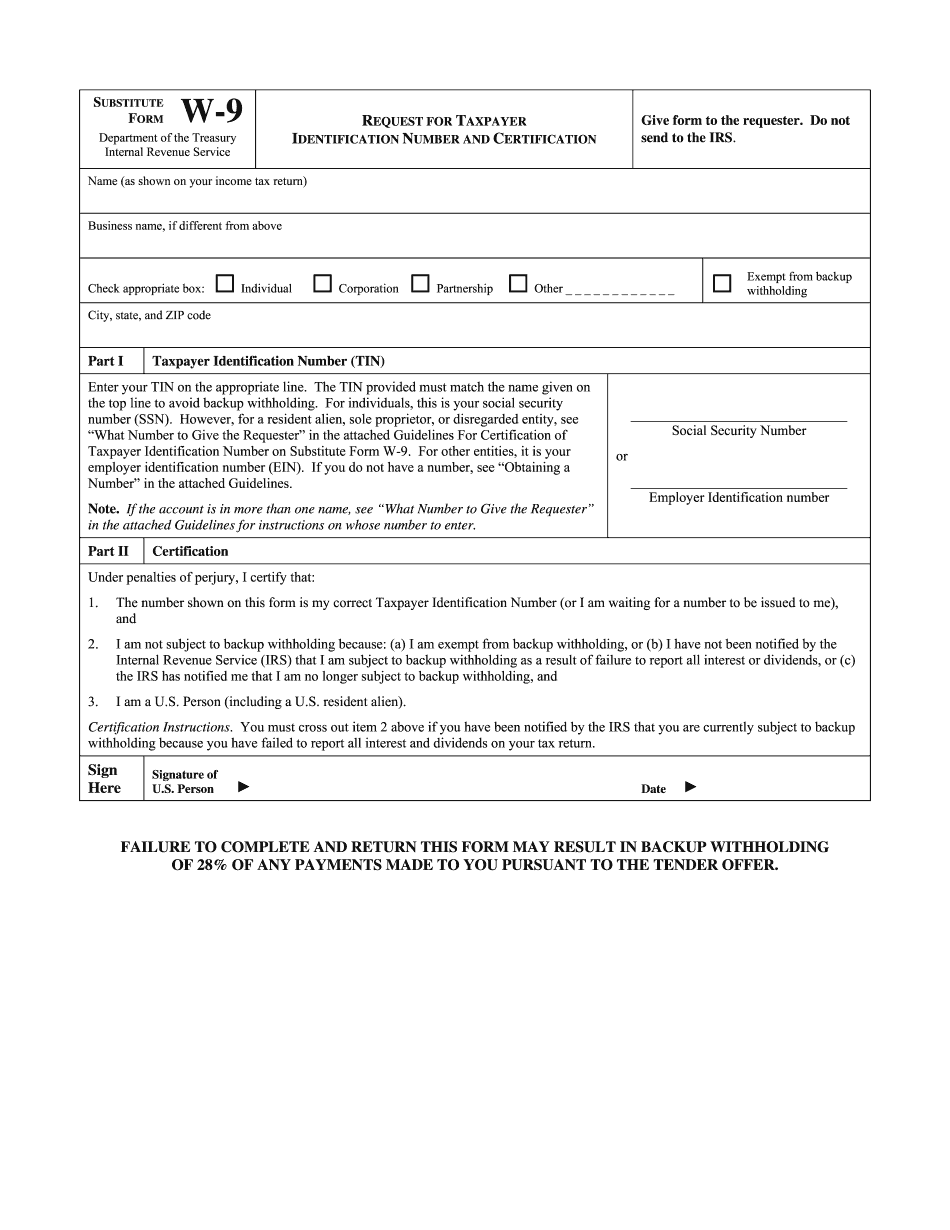

Request for Taxpayer Identification Number and Certification — Boston University 1. How to Get Your W-9 A. If your company pays a quarterly federal tax, complete Form W-9. The due date of this form is April 15, even if you do not receive your payment until May 15. B. The tax is withheld on any payment that is not received until after the due date of the form. If you submit Form W-9, you have fulfilled your obligation. C. When you are a small U.S. corporation, you still do not need a W-9 from your owner. If you have not changed your name to Boston University by the end of the year, send your Form 1065, Certificate of U.S. Tax Withholding, to our office with payment in the form of a check, money order, or money transfer. In such cases, we may require proof by check or money order of the name change before allowing you to issue Form W-9. 2. Getting Your TIN A. Form W-9 can be sent to the office of the Boston University Tax Department, Room 101C, Suite 1A, 1265 Commonwealth Avenue, Boston, MA 02215, Attention: Associate Corporate Secretary, Tax Bureau. B. If you pay directly with a check, money order, or foreign currency and the check is presented in person to the Boston University Tax Business Division prior to filing your tax return, the check will be endorsed as payment in the amount of 10, including all applicable penalties and interest. The amount of any check that is accepted in person with a valid tax return will be assessed any applicable penalties and interest on that amount. C. A payment in exchange for Form W-9 must be made to our office within the state of Massachusetts or to the Boston University Tax Business Division by any means allowed by Massachusetts law. 3. What to Expect on Receiving the Tax Return You can expect us to open your tax return and to review the appropriate box as well as any boxes you have marked “Confidential” with an underlined question mark in the space provided on the form. If the box is not marked “Confidential”, the box will not be opened. The only exception is when we are investigating a violation or claim.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Boston Massachusetts W9 Ument, keep away from glitches and furnish it inside a timely method:

How to complete a Boston Massachusetts W9 Ument?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Boston Massachusetts W9 Ument aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Boston Massachusetts W9 Ument from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.