Award-winning PDF software

W9 Ument for Burbank California: What You Should Know

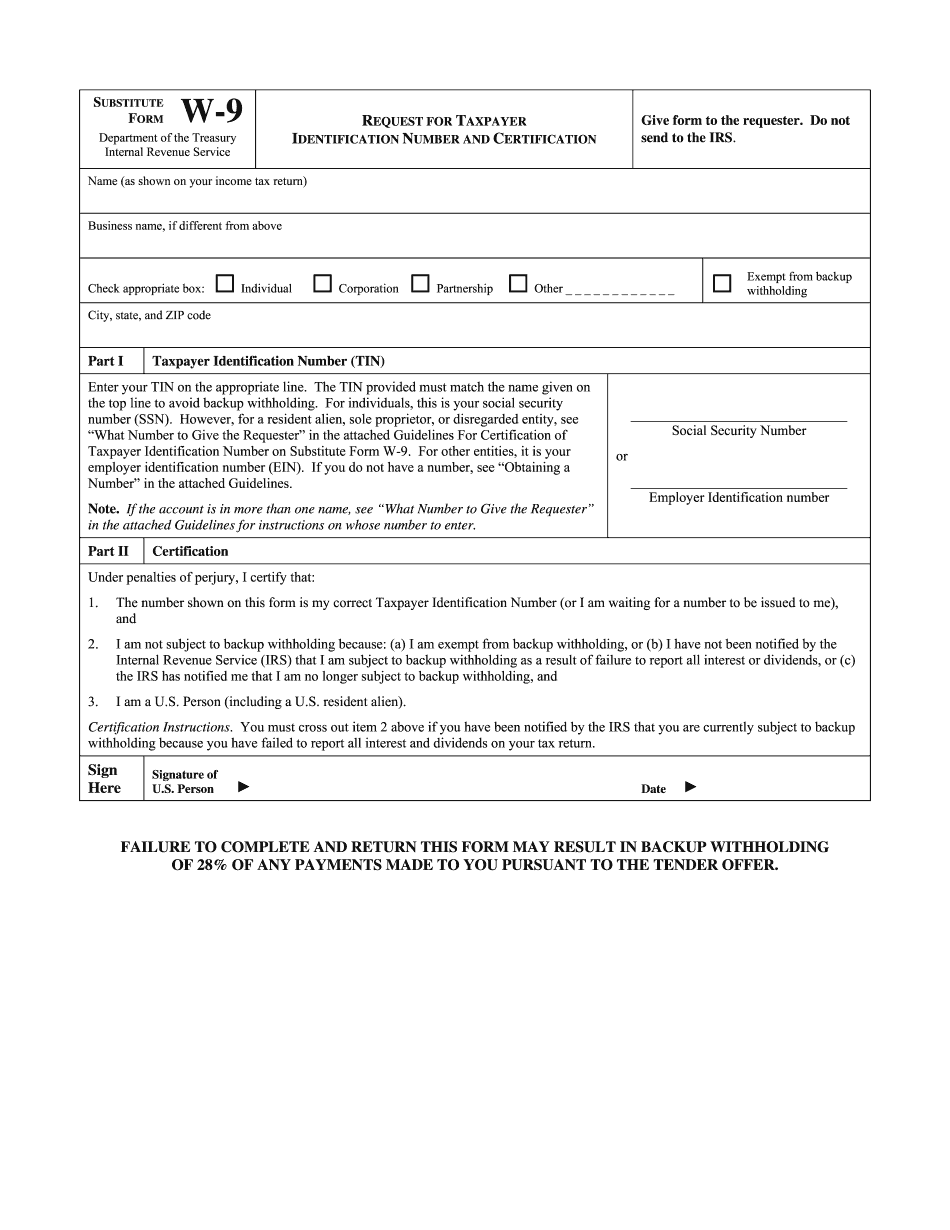

W-9 (Filing/Payment) Form 1150, Certificate of Self-Employment “We have a special relationship with you and your business. Your continued business has been a benefit to us. We have made a number of payments through the payments link you have used to report or pay back the payments we are making to your account (it is to the credit of the business). If any of the payments made on your behalf are not completed, they will be reversed. If the payments are not reversed, they may impact your credit standing and, by extension, affect your ability to open new accounts. However, we are not liable for any of these payments if you fail to report them on Form 1090 or Form 1099. It is a good idea to keep your W-9 handy to report payments to the business entity” “We want to make sure you understand that if we pay you money through a payments link and that payment is not reported on Form 1099, then that payment will be reversed as soon as the payments become due (generally 30 days after the last payment). If you made a payment by check, and you do not claim it on line 9 of Form 1099, then you can request that we pay you back directly by electronic transfer through the link on our website.” (from). The same rule applies if you receive payments by direct deposit to an automatic teller machine, and you submit those payments directly to your business and do not report them on line 9 of Form 1099. This is because the automatic teller machine will pay these deposits right back to your business account. This form should be filed each time a business makes a payment in order to avoid the penalty of late filings (Filing and Payment) (Section 6695C) (see link for additional information) that applies to reporting or reporting electronically on Form 1099 (section 6662) (if the payment was reported electronically on Form 1099 but failed to be reported on other forms, see information on Forms 1099 and 1099A (Form 1000) and Forms 1005-G (form 1000-G)). Note that section 6695C, the late reporting penalty, only applies to reporting, not payments or payments by electronic transfer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument for Burbank California, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument for Burbank California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument for Burbank California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument for Burbank California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.