Award-winning PDF software

W9 Ument for Frisco Texas: What You Should Know

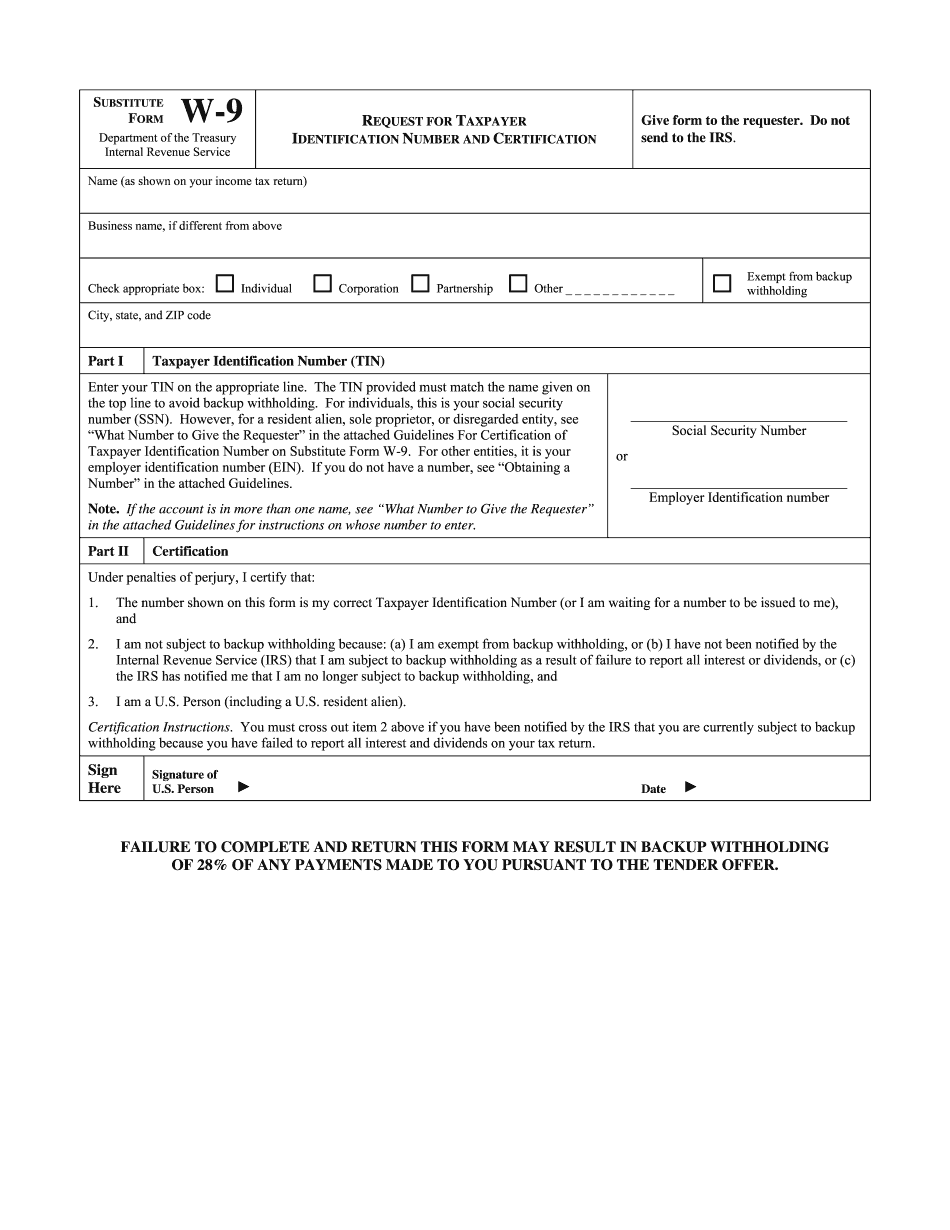

This form may be used to request information from a Federal Tax Agency (e.g., the Internal Revenue Service (IRS), Social Security Administration (SSA), Internal Labor Relations Board, etc.) regarding a taxpayer's records that have been transferred, transferred to you, or received in electronic form by the Tax Authority from any other Federal or State or Local government agency that is collecting, retaining, or reporting any information that relates to the original taxpayer (as evidenced by records such as pay stubs/account entries or records generated from electronic or mechanical means) through a tax system in a manner similar to a paper taxpayer record. The IRS accepts written requests from eligible applicants for taxpayer record access in the Form 712, Electronic Data Interchange (DATA). This form may be used for all types of requests, which must include the following items: A description of the type of records requested, The number of documents, including pay stubs/accounts, requested, and The IRS mailing address, fax Number, or postal Address. The IRS cannot respond to requests which do not contain all requested information. This form may be used for information requests to the IRS or the U.S. Government regarding a foreign financial institution (an entity that is registered with the IRS as a financial institution). This form may be used to request an identification number, other than the Taxpayer Identification Number (TIN) for any individual taxpayer. This form may be used to request information that is provided to any government agency. This form may be used to request records from a foreign government agency for international taxation matters. This form may be used to obtain a TIN or to request the TIN number for a spouse or child, other than for international taxation reasons. The following questions should be used as a guideline for the type of person for whom a request is made : Was this taxpayer a nonresident or foreign resident for all tax years in the calendar quarter in which this request is mailed? In order to determine the correct recipient of a Form W-9, you must complete Form 2106, Employee and Independent Contractor's Certification of Taxpayer Identity or Affiliation. Form 1099-MISC and Federal Income Tax Return This form is for individuals and/or small business concerns. This form indicates that there is a balance due on a U.S. individual income tax return for a tax year ending in the calendar year specified on the bottom of this form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument for Frisco Texas, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument for Frisco Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument for Frisco Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument for Frisco Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.