Award-winning PDF software

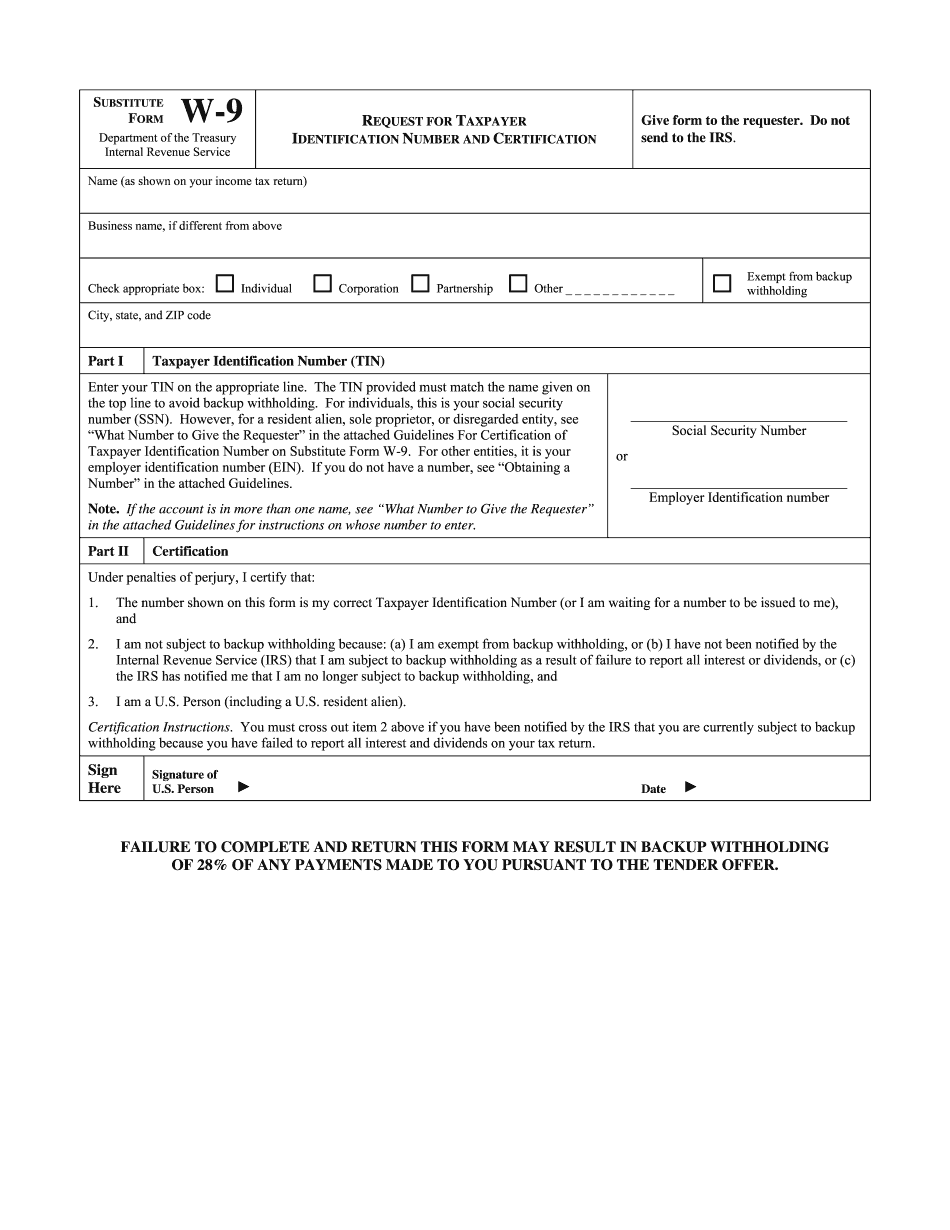

W9 Ument for Lewisville Texas: What You Should Know

Free Tax Prep in Lewisville. If you earn up to 28,501, you can have a lawyer, public accountant, or even a nonprofit prepare your taxes for you (no need to make a decision for at least a few days). Contact us today. No obligation. About Tax Day 2018: This Year's IRS Tax Fair The official IRS website is set for Tax Day 2018: April 18, the date of the latest installment of the popular “American tax system,” the Tax Code. There are two main ways you can get information: Do-It-Yourself If you live in a community, county, state, or even country, you may be able to receive free tax preparer assistance or other assistance. We are the largest volunteer organization in the U.S. that provides free information to taxpayers from hundreds of countries. About the IRS If you are currently or have ever volunteered as an IRS volunteer before, it is easy to re-apply to become a tax-filer. In fact, all you need is a valid e-mail address. The IRS is a civil servant and must have respect for the Constitution and other laws of the country in which it performs its duties. The U.S. federal government has no religious or political opinions. While the IRS does not endorse any view of any religion, it does take an oath of office and makes clear that it has 'no opinion concerning the propriety, morality, efficacy or authority of religious training' nor is it affiliated with any religious, political or philosophical organization in any way. If you want to volunteer as an IRS volunteer now… You can start by visiting our Volunteer page to find out more and sign up. If you are already an IRS volunteer, it all starts here, and you can learn more about the various tax-filing options available to you, including your eligibility and training, in the Volunteer Guide. If you're a new Volunteer, click here to access our new Volunteer Application and Guidelines. The IRS has never required taxpayers to sign a paper form, and the IRS does not ask taxpayers for a signature, though every year the federal government must determine how to accurately and completely file federal tax returns with accuracy, fairness, and consistency. It has never been a requirement that the Form W-9 be signed, though many taxpayers do, and many more do not even know about the requirement. The U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument for Lewisville Texas, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument for Lewisville Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument for Lewisville Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument for Lewisville Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.