Award-winning PDF software

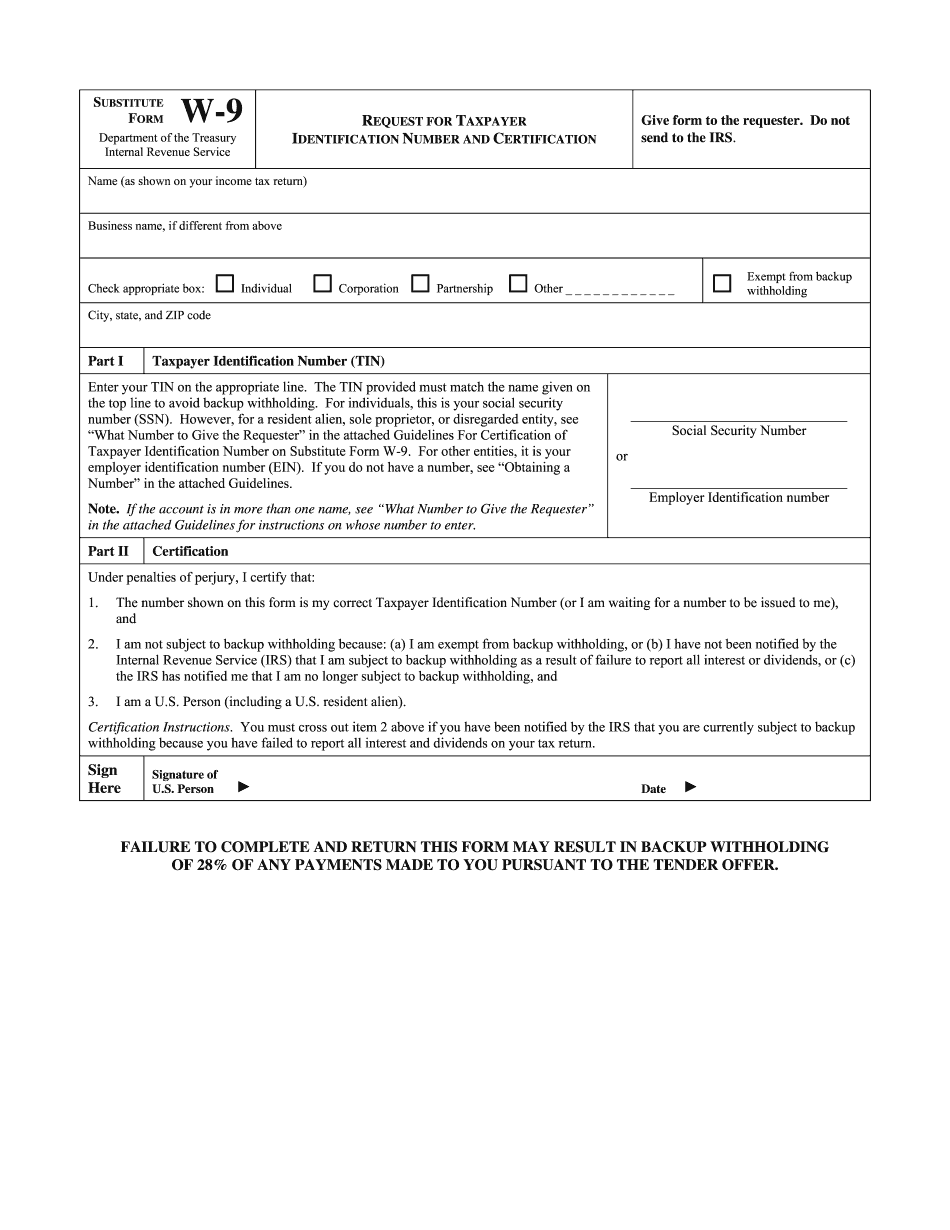

W9 Ument for North Charleston South Carolina: What You Should Know

Article 24(c) of the South Carolina Constitution provides that “the legislative authority shall have the power to provide by general laws for the collection, deposit, valuation, and disposal of all taxes, duties, imposts, and excises paid or payable by the people of the County, except such as are levied by the county upon the property of other counties.” The state constitution gives Authority to Collect and Deposit Taxes and other charges. The tax rate is 5% for homeowners; 5.5% for non- homeowners at a single person's residence; 8% for homeowners; 6% for non-owners at two persons residence; 10% for non-owners at three persons residence; 12% for homeowners at four persons residence; 15% for businesses, and 20% for non-profits. Article 9, SC Constitution Section 7A — Tax on property, the amount of taxes imposed as a result of a transaction between the State and any of said counties or communities in the state, shall be and the same is the same as imposed upon a person who resides in the state, shall be levied, collected, and paid in the same manner and the same shall be subject to the same rules and taxation, as if the person were a resident of another state if the following conditions exist: a. A person does not personally possess or use an object within the state; b. The person is no longer physically present in the state; c. The person's presence is determined by the application of a common carrier acting on behalf of the individual; d. The non-residence- status of an individual is established by a declaration made and signed before a county executive or county official in the county in a form that meets the requirements of this act; or e. A tax for the transaction is based on a person not present in the state of South Carolina. Taxes on property, based on non-resident status, can be collected at the following rates for a taxable person: 10 gross rental value from a property.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument for North Charleston South Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument for North Charleston South Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument for North Charleston South Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument for North Charleston South Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.