Award-winning PDF software

W9 Ument online Columbus Ohio: What You Should Know

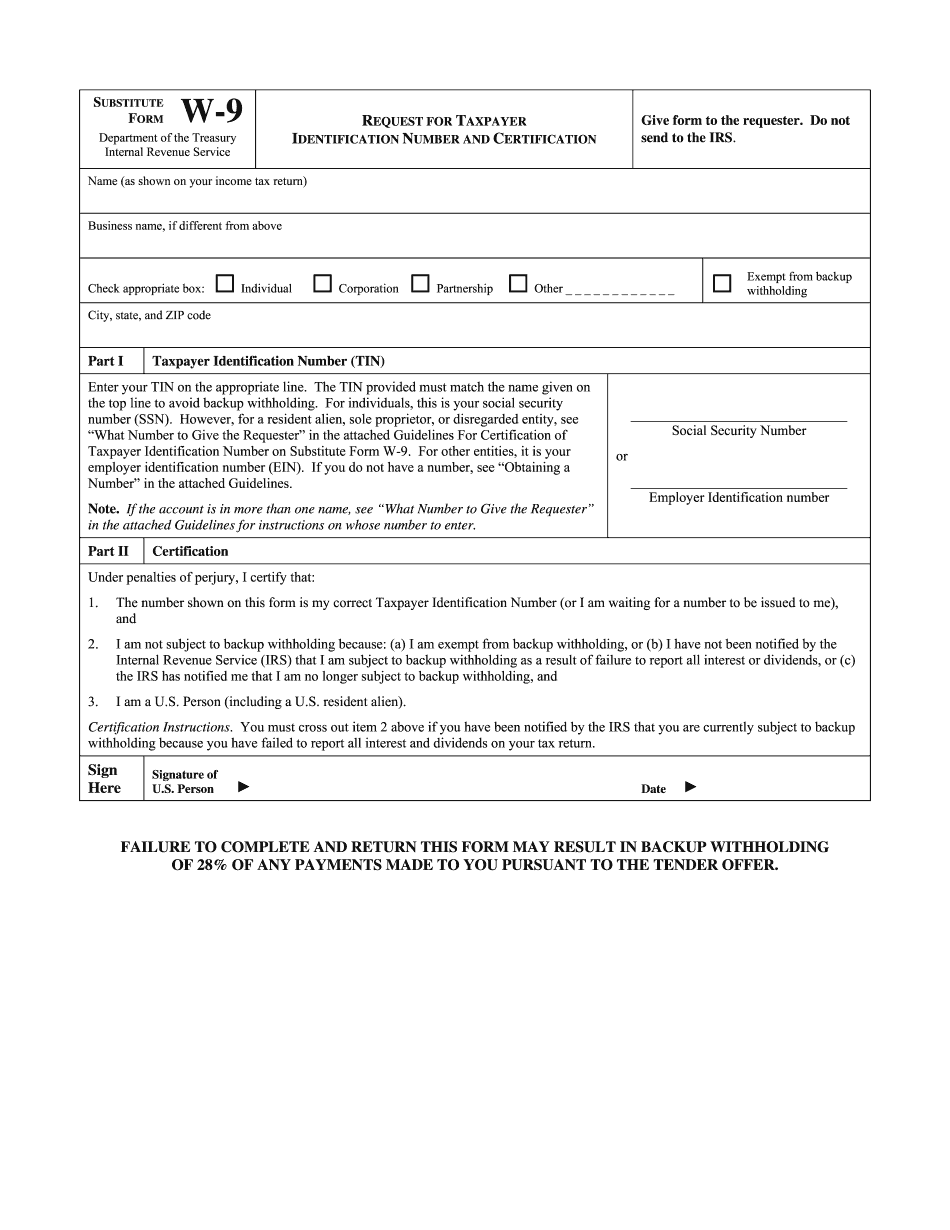

Please do not upload your W-9 to an official document. Online filing for the first time or if an existing W-9 is incomplete Please take a minute to read the following instructions on the W9 website. If you have received an online form in the mail for filing your tax returns, it means that you are on a payroll process. Please follow the online guidelines provided for online filing. If you have received a letter asking you to submit your tax return electronically, please see this page for more information. If you are unable to access the Internet for any reason, please use an alternative method of filing your return such as facsimile transmission, writing a check or calling the IRS. We are aware that some people find it difficult to view, read or complete this form. Please try it again, depending on your internet access. You may need your employer's signature on the W-9 form, so we can verify your employee's status and pay tax on his or her behalf. If you are a new Ohio resident and would like to register to vote, please visit your local voter registration office. The W-9 form and instructions may also contain errors. Please note this if you notice any. If we think you have made an error, please call us at to verify that you are eligible to file for an Ohio W-9 form that will issue you a tax identification number (TIN). To find your correct Ohio TIN, please click here. The W-9 form can be found in the Form W-9 on page 4 of the Guide to the Forms, Statements, and Publications of the Internal Revenue Service. If you are having problems with the application of the W-9, you can contact the National Taxpayer Advocate at or. Please note that the National Taxpayer Advocate is not an enforcement entity. For further help, try one of the following links: The IRS has a number of tax forms and publications you can request to help you file your federal tax return. You may even have questions about an issue with a particular tax form, and you probably have questions about all tax forms. The IRS provides many ways for taxpayers to obtain tax forms and other publications to help them do their job and to file complete tax returns.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument online Columbus Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument online Columbus Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument online Columbus Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument online Columbus Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.