Award-winning PDF software

W9 Ument online Green Bay Wisconsin: What You Should Know

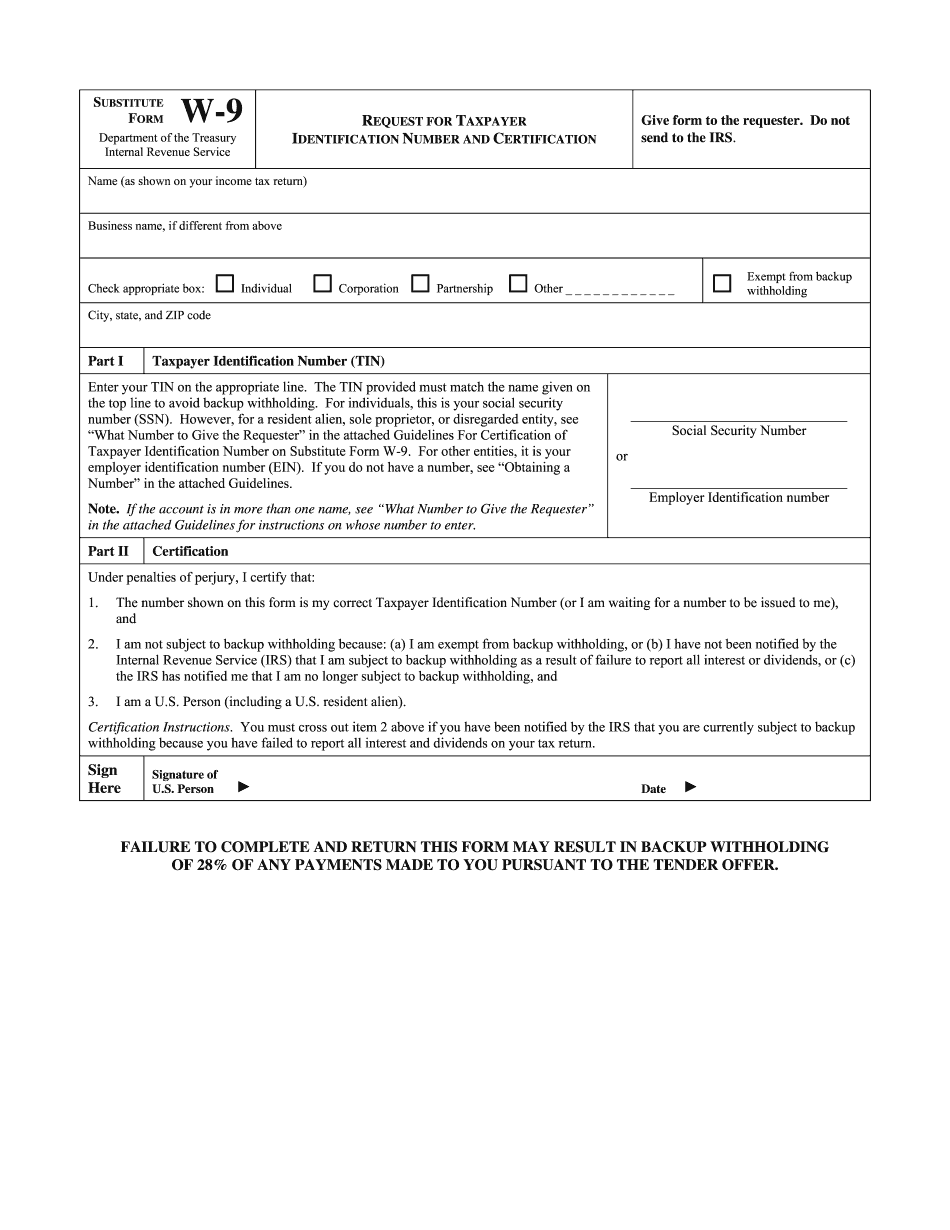

It is imperative that you follow the filing and payment deadlines for non-compliant vendors. Please complete a W9 and then report all payments as required by federal tax law. You should report all payments from an agency contractor to a company that provides services to your company, like a sales rep or web development company. In these non-compliant times, the Wisconsin Department of Revenue has updated its Taxpayer Identification Number (TIN) requirements effective July 1, 2018. Please view and download the new Form W-2 (W-2-SA) and Form W-1 (W-1-SA) forms. When filing the Form 1099-MISC as an employee, you must attach the Form 1099-MISC at page 1 of the 1099-MISC, and indicate the vendor's U.S. Employer Identification Number on line 12. In this new year, you should file your form at least 60 calendar days before your pay date. You should also be aware of certain forms that you must include with your 1099, including the Form 1099-MISC and Forms W-2G, W-2G-EZ and W-2G-S. These forms are required when a taxpayer creates a transaction on which tax is paid to an entity, either foreign or domestic, that is not a U.S. entity, in accordance with Internal Revenue Code Section 6038(b). Vendor Listening Session — February 2014 “I am doing a lot of work with the same vendor that helped me with my business. The same vendor, who I hired to service my small business. I found out when I did a search on this website that it is illegal to pay the vendor in cash. The vendor is using a credit card, so I need to get a warrant to see their bank account. Also, my accountant found out about this when doing our next audit. So the vendor must pay me in cash or a check for the business. They have a checking account with this small business but won't give me that account number. The vendor is taking a 1,200 deduction from their paycheck and not paying us what money is owed to us. I am just going to file a complaint with our county commission. My business is paying this vendor over 500.00 each month.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument online Green Bay Wisconsin, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument online Green Bay Wisconsin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument online Green Bay Wisconsin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument online Green Bay Wisconsin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.