Award-winning PDF software

W9 Ument for Santa Clara California: What You Should Know

Greg Abbott directs this office, manages a budget deficit of 19 billion — a staggering amount — and he is fighting to balance the budget without raising taxes or fees. Governor Abbott works closely with the Revenue Department to protect and protect taxpayers from any tax increases. The Revenue Department has been awarded an unprecedented number of State Seal Awards, which have gone to many of the top tax department personnel. The Texas Comptroller of Public Accounts provides the financial oversight necessary to protect taxpayers from tax increases. Gov. Abbott's top priorities are to protect taxpayers from any tax increases, to keep taxes affordable, to provide public education and jobs, to provide for justice and compassion and to provide the strongest and healthiest economy in the nation. Governor Abbott has appointed a cabinet and deputy chiefs of staff to meet daily with the Governor's top tax-enforcement executive. The Governor's office is the lead agency, with a staff of more than 1,700, to manage an unprecedented number and variety of tax collections across the state. The Comptroller's revenue estimates come from all the property, sales, income, corporate, and other sources that Texas property taxpayers rely upon for their annual income taxes. The Comptroller's office works with local governments and businesses to provide accurate tax information so that the public, businesses, and state government can meet its obligations. The Comptroller's office is proud to be working in partnership with the Governor's Office of Economic Development and Workforce Development to promote the goals of building a strong Texas economy and expanding opportunity. Read about “Revenue Estimates” in Gov. Abbott's FY2018-FY19 Budget Recommendations and read about “In-Place Tax Collection” in Gov. Abbott's Tax Facts FY2018-FY19 report.

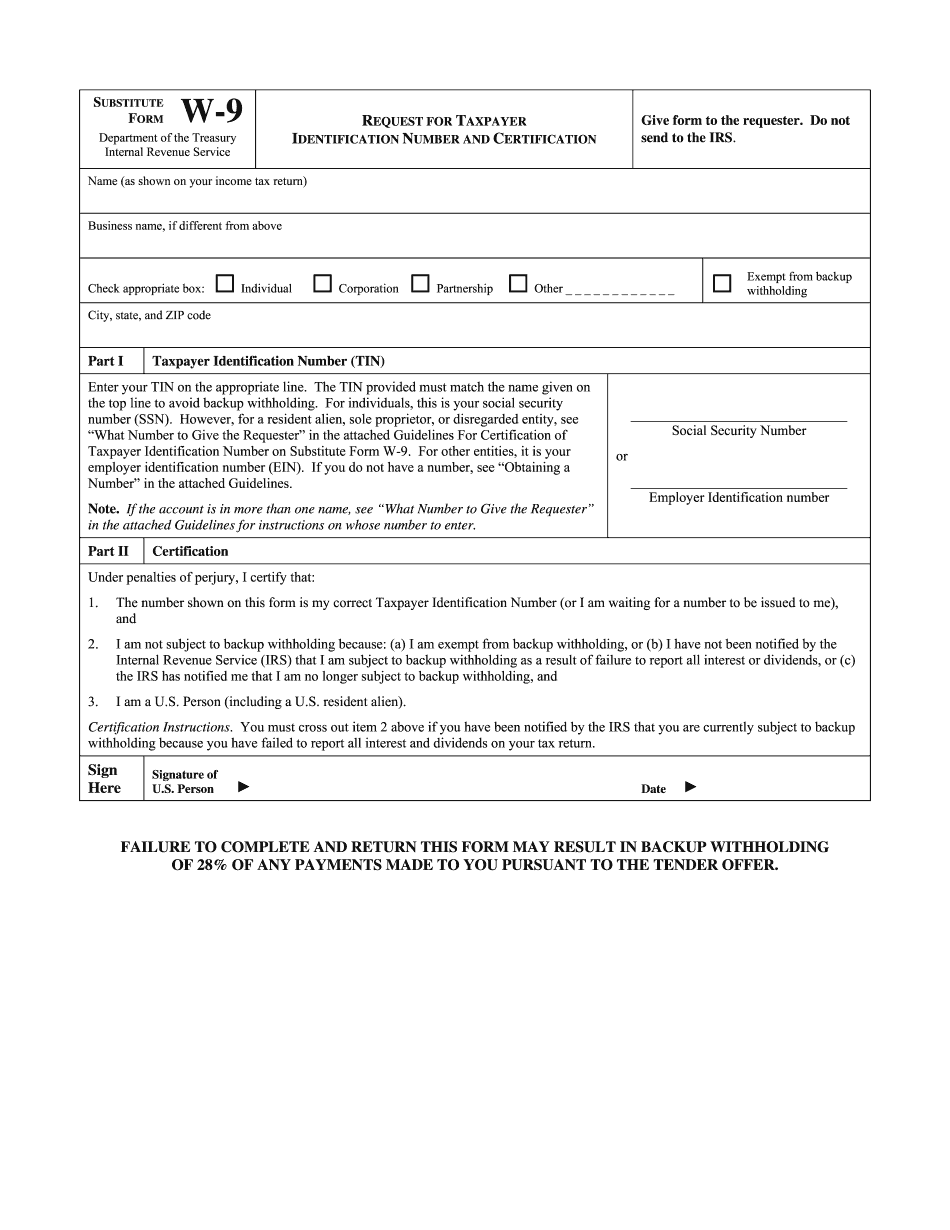

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument for Santa Clara California, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument for Santa Clara California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument for Santa Clara California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument for Santa Clara California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.