Award-winning PDF software

W9 Ument for Georgia: What You Should Know

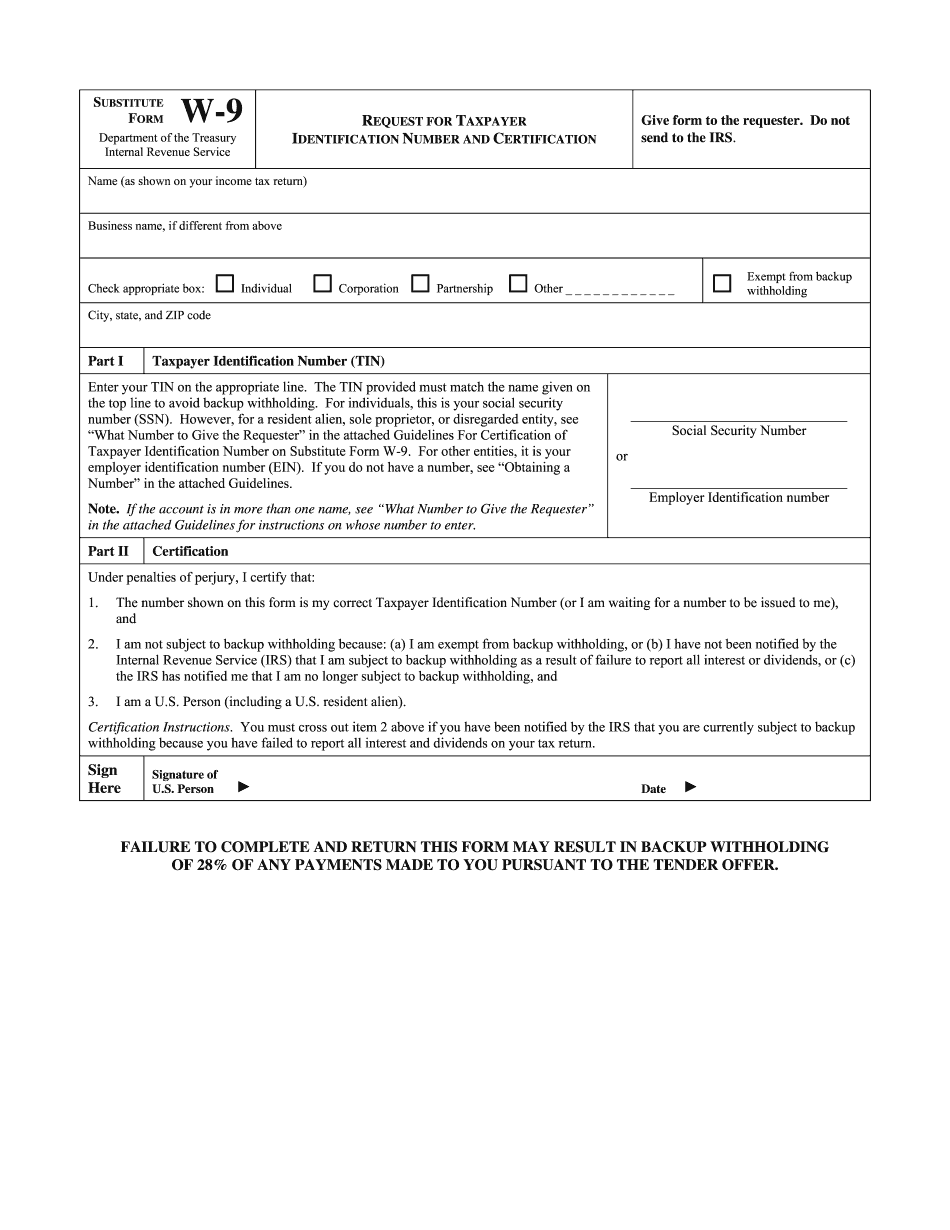

S. Person to provide your correct TIN. If you do not return Form W-9 to the requester with a TIN, 2 W-9 Fill Online, Printable, Fillable, Blank Taxes Payable on W-4s (Form 1040-ES), W-4s/Seas, W-10s, W-10A, and W-13A Using IRS Forms 1023 (Form 1023), 5498 (Form 5498), and W-4P (Form 5498P) This is a summary of current federal income tax and social security law under the tax rules for 2018. This summary is not intended to provide tax or legal advice. You should consult your own tax advisor regarding tax matters. Forms and instructions for these tax forms and instructions are published in the annual IRS publication, Tax Notes. 2018 Federal Income Tax Filing Guidelines The 2025 tax filing season opens Monday, April 18, 2025 and end on Friday, November 24, 2018. Beginning in April, taxpayers with taxable income (including interest and dividends) above 20,000 in their most recently completed year of taxation are required to use the “standard Filing Status” for tax returns, regardless of whether they have filed a joint return or filed separately. Income tax rates and tax filing requirements for 2025 depend on whether you can claim itemized deductions. Filing your tax return early (before April 18, 2018), can help you reduce your tax bill even if you don't owe any tax by filing late. The IRS encourages taxpayers, beginning in April 2018, to take advantage of the IRS e-file technology which provides taxpayers a tax-preferred electronic filing environment. To file electronically, go to , create an FSA ID, and then file your tax return online or by telephone in direct deposit. The IRS is unable to accept postal mail for returns. You may also use IRS Express Services (by phone or for IRS mail) to file your form at a later date. IRS e-file system is only available to taxpayers who have filed a Form 1040-PR using the 2025 tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument for Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument for Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument for Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument for Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.