Award-winning PDF software

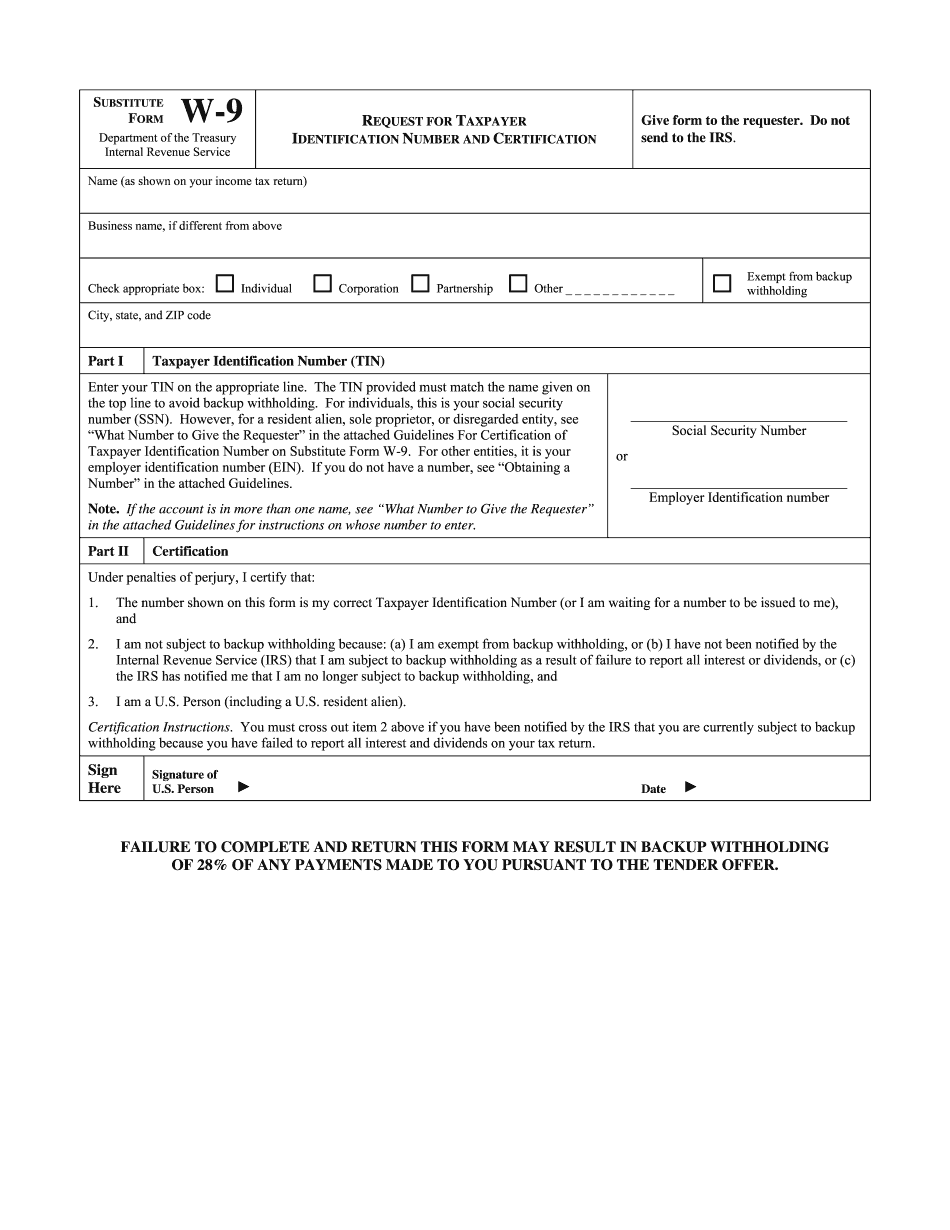

W9 Ument for New Jersey: What You Should Know

My Signature — Fill Out and Sign Printable PDF Template W-9 Forms — Fill Out and Sign Printable PDF Template FIND OUT ABOUT TAXPAYERS WHO HAVE BECOME SURETY BANKERS : Taxpayers who are becoming surety bankers should make the change before filing their income tax returns. Income Tax Filing Changes For Filing Tax Returns You may want to consider preparing for your own FAFSA. If so, do it before you even file your tax return. How to become a Surety Bank : When a person becomes a surety for another, the amount set as bail in the bond is the amount for which the obliged is liable. This is the person you will be liable for payment of the entire bond amount. The person is the surety. A surety's liability attaches when the property is delivered to the surety. You cannot assign a surety ship or mortgage. If you want to assign this type of property for surety payments, you will need a deed of trust and the necessary documents. The surety bond is for one year. The surety must deliver the property to the obliged within 30 days after delivery, and make such delivery the property is unharmed. A claim of a surety is against the obliged in the amount of the bond. So a person in bail may be in a position to claim the amount for the surety after taking over the property. Surety bonds for businesses can be sold in the State Treasurer's Office. If you desire to sell a surety bond, the transaction must have been in effect a while before you sold the bond. It must require a certificate of insurance from S&T insurance Company. A surety bond has the same effect as a mortgage. All payments must go to the obliged, the surety, whether the property is sold on the same day the payment for the surety bond is made. All surety bonds must have a certificate of insurance with them when they are delivered to the surety to release the obligations. The certificate will authorize the person delivering the bond to hold a lien for payment of the surety bond for a period of time. So the surety will hold the lien while the property goes under contract.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete W9 Ument for New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a W9 Ument for New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your W9 Ument for New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your W9 Ument for New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.