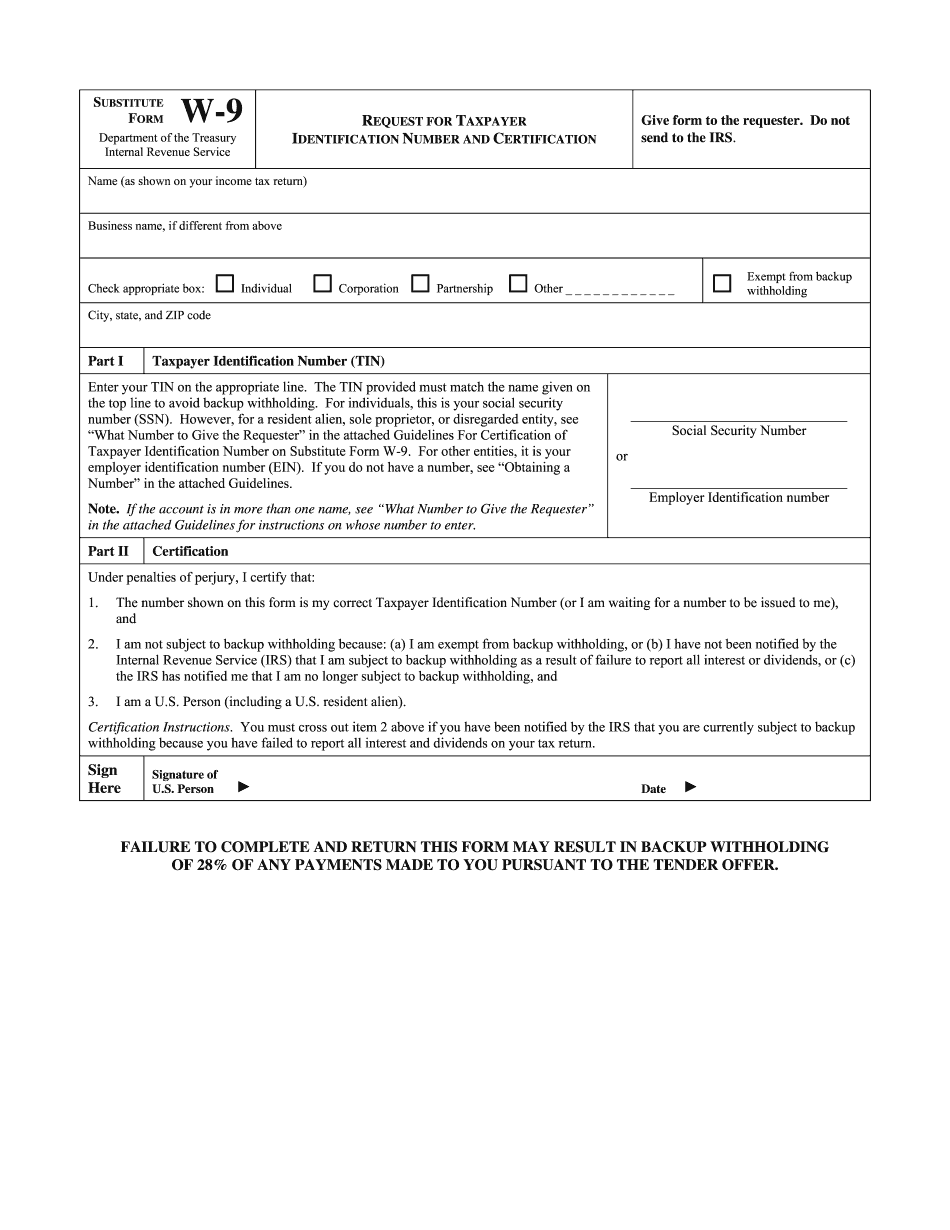

Hello my name is Katie Sanskrit with CNRS wealth management and in this video we're going to talk about how to fill out form w-9. Let's get going first. If you received a form w9 to fill out, then use that paper form. If you would like to go to the IRS website google and search for w9, you will see IRS.gov website and form w9. If you click on it, you will be able to see form w9 which says request for taxpayer identification number and certification. The poor is only one page long the rest of the pages are instructions. You can fill it out and save it to your computer. Let's get to the four. If you are sole proprietor, small business owner, independent contractor, or freelancer, often you will get a form w-9 from a company or in digital that you're doing the work for. They use this form to collect your personal information, and you rein number later. They use that w9 form and information in it to fill out form 1099 which will be sent to you to the address you include in this form. So later during the tax time, you will use that 1099 form to prepare your income tax return. I would like to go through couple options first. One will be sole proprietor. Second will be single member LLC. Third will be an s corporation. First very important note that I have to point out you have to give this form after you fill it out to the person or company that requested this form. You can get this form from your financial institution. If you're receiving some interest income or dividends, so you have to fill this form out and return it back to them. Do not send this...

PDF editing your way

Complete or edit your W9 Ument anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export W9 Ument directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your W9 Ument as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your W9 Ument by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Tax Return

- The W-9 form is not submitted to the IRS but is kept on file by the requester.

- Failure to provide a correct taxpayer identification number on the W-9 form may result in backup withholding.

- The W-9 form is often used by businesses to request information from vendors and contractors.

Award-winning PDF software

How to prepare Tax Return

About W9 Ument

A W-9 form is an official document used in the United States for tax purposes. It is provided by individuals or entities who are considered "payees" to request taxpayer identification information from the person or business making a payment to them. The purpose of the form is to report income earned through various payment transactions, such as freelancing, consulting, rental income, or other self-employment activities. The W-9 form includes personal information such as name, address, and taxpayer identification number (TIN), which can be a Social Security Number (SSN) or an Employer Identification Number (EIN) for businesses. The completed W-9 form is submitted to the payee who then uses the information to accurately report payments made to the Internal Revenue Service (IRS) and provide the payee with Form 1099. Individuals or entities who need a W-9 form are typically those who make payments to independent contractors, freelancers, vendors, or other businesses that are not their employees. This includes companies, organizations, landlords, and clients who engage in financial transactions exceeding a certain threshold set by the IRS. By obtaining a W-9 form, these payees ensure they have the necessary information to comply with tax reporting requirements, including issuing accurate Form 1099s.

How to complete a Tax Return

- Enter your Name as shown on the form

- Provide your Taxpayer Identification Number when requested

- Certify the information provided is accurate by signing the form

- Do not send the form to the IRS, instead, give it to the requester

People also ask about Tax Return

What people say about us

E-forms increase overall productivity

Video instructions and help with filling out and completing Tax Return